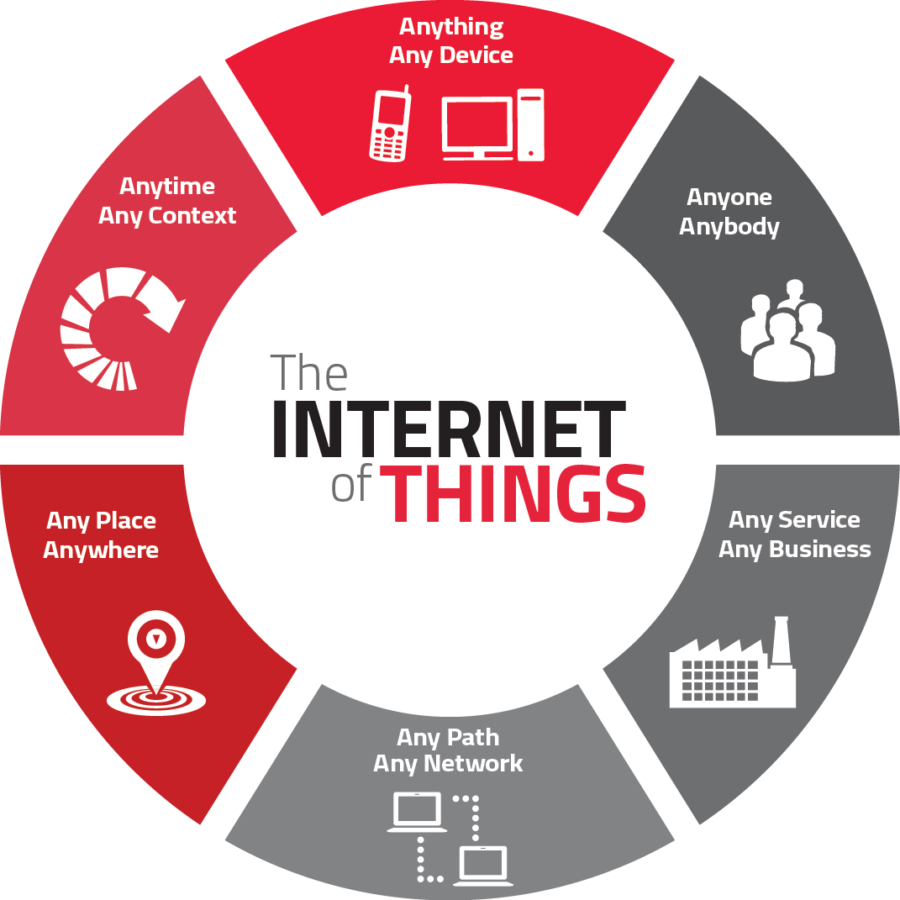

Regardless of size, many IoT firms frame themselves to stakeholders as platform builders. They focus on a number of areas, with cloud, networking, hardware, data and security being the predominant ones. The essential buildout rationale is that these firms want to be the infrastructure other companies turn to and utilize to create their services, connect their hardware, manage their data, and satisfy their customers.

While needs vary by IoT domain – such as home automation or industrial IoT – every firm requires that a potential platform have a set of building blocks based on open standards, flexibility, security, and scalable data architectures.

In my view, there are four clear indicators of an IoT platform.

- The platform provides the essential glue for others in a product ecosystem and more broadly for a system of systems.

- The platform provides significant performance increases for participants.

- The platform broadens the IoT domain playground for stakeholders outside the industry.

- The platform reduces complexity for other firms and allows them to focus on what they do best.

Getting to the heart of a platform’s strategic differentiation requires some sleuthing because most IoT firms want you to believe they are building a platform for everyone in one form or another. The pressure to offer something to all is simply too strong. Specialized language makes the discover process more challenging as well.

In my view, there are four critical areas of inquiry for determining platform competitive positioning and trade-offs.

- Does the platform optimize performance for a product ecosystem or a system of systems?

- What trade-offs have been made to focus on the product ecosystem or on a system of systems?

- Which industry competitors are on a particular platform or platforms?

- Who owns the data – the platform, the service provider, the firm, or the customer?

At their core, none of the above questions are about technology. They are about looking at one’s industry structure and then thinking through how a firm is going to reshape that structure using one or more platforms. For example, Netflix has an annual contract with AWS for USD $800 million. Would Discovery Communications – a competitor – entrust its programming platform to AWS as well, even if AWS has the very best platform for any media company? To date, Discovery Communications executives have said definitely not.

Clearly, there are many other important areas to investigate – security, cost, third party management partnerships, hardware and data certifications, development tools, facility geographic diversity – among others. But are answers to these questions going to be relevant if key strategic positioning and industry structure remain unclear when evaluating a platform provider?

No.

If your firm defines itself as a platform, it needs to provide essential glue, increase performance, broaden the playground, and reduce complexity. If your firm meets the criteria of a platform, the firm’s activities need to be focused around optimizing performance, defining ecosystems, understanding industry vertical competition, and defining data ownership. Doing so will clearly shape competitive advantage and trade-offs against competing platforms and articulate the firm’s value proposition with customers.